Looking for the best business credit card for your small business? Here's a quick guide to help you choose the right one based on your needs:

- Hello Alice Small Business Mastercard: Great for building credit with rewards tailored to wireless services, office supplies, and more. No annual fee and 0% intro APR for 6 months.

- Capital One Spark Cash Plus: Simple 2% cash back on all purchases. Ideal for businesses with diverse spending and no preset spending limit.

- U.S. Bank Business Triple Cash Rewards: Earn 3% cash back on gas, office supplies, and telecom services. 0% intro APR for 15 months.

- Ink Business Unlimited Credit Card: Flat 1.5% cash back on all purchases with no annual fee. Perfect for varied expenses.

- Ramp Business Credit Card: Unlimited 1.5% cash back and zero fees, with advanced expense management tools.

Quick Comparison Table

| Card | Annual Fee | Rewards | Intro APR | Best For |

|---|---|---|---|---|

| Hello Alice Mastercard | $0 | Up to 4x points on select categories | 0% for 6 months | Building credit, startups |

| Capital One Spark Cash Plus | $150 (waived first year) | 2% cash back on all purchases | N/A | Consistent cash back |

| U.S. Bank Triple Cash Rewards | $0 (first year, $95 after) | 3% cash back on gas, office supplies, telecom | 0% for 15 months | High spending in bonus categories |

| Ink Business Unlimited | $0 | 1.5% cash back on all purchases | 0% for 12 months | Simplicity, no category tracking |

| Ramp Business Card | $0 | 1.5% cash back on all purchases | N/A | Expense management, no fees |

Choose based on your business's spending habits, need for rewards, and financial priorities. A good credit card can simplify expense tracking, earn rewards, and help you grow your business.

The 9 Best Business Credit Cards of 2024

1. Hello Alice Small Business Mastercard

The Hello Alice Small Business Mastercard is designed for small business owners aiming to build credit while gaining access to helpful business tools. With no annual fee and a 0% introductory APR for the first six billing cycles on purchases and balance transfers, this card can help manage startup expenses efficiently [2].

The rewards structure is appealing: 4x points on wireless services and software, 3x points on office supplies and shipping, 2x points on rideshare and dining, and 1.5x points on all other purchases. New cardholders can also earn a $50 statement credit after spending $1,000 within the first three billing cycles [2][3].

Hello Alice co-founders Elizabeth Gore and Carolyn Rodz emphasize the card’s mission:

"We designed the Hello Alice Small Business Mastercard to meet the needs of small business owners where they are, breaking longstanding barriers to mentorship, access to credit, and overall financial health for those who have traditionally been denied access." [1]

The card integrates with Hello Alice's platform, offering one-on-one coaching and expert business advice [2][4]. It also comes with standard Mastercard protections like ID Theft Protection, Zero Liability, and car rental insurance.

For business owners with limited credit history, there’s a secured version of the card that can transition to unsecured status in as little as 12 months, pending approval [1][3]. This feature is particularly beneficial for Hello Alice's diverse community, which includes 68% BIPOC and 63% female business owners [1].

After the introductory period, the APR ranges from 19.99% to 28.99%, depending on creditworthiness [2]. With its rewards program and credit-building features, this card is a practical choice for small businesses in their early stages.

If cashback rewards are your focus, the next card might be worth considering.

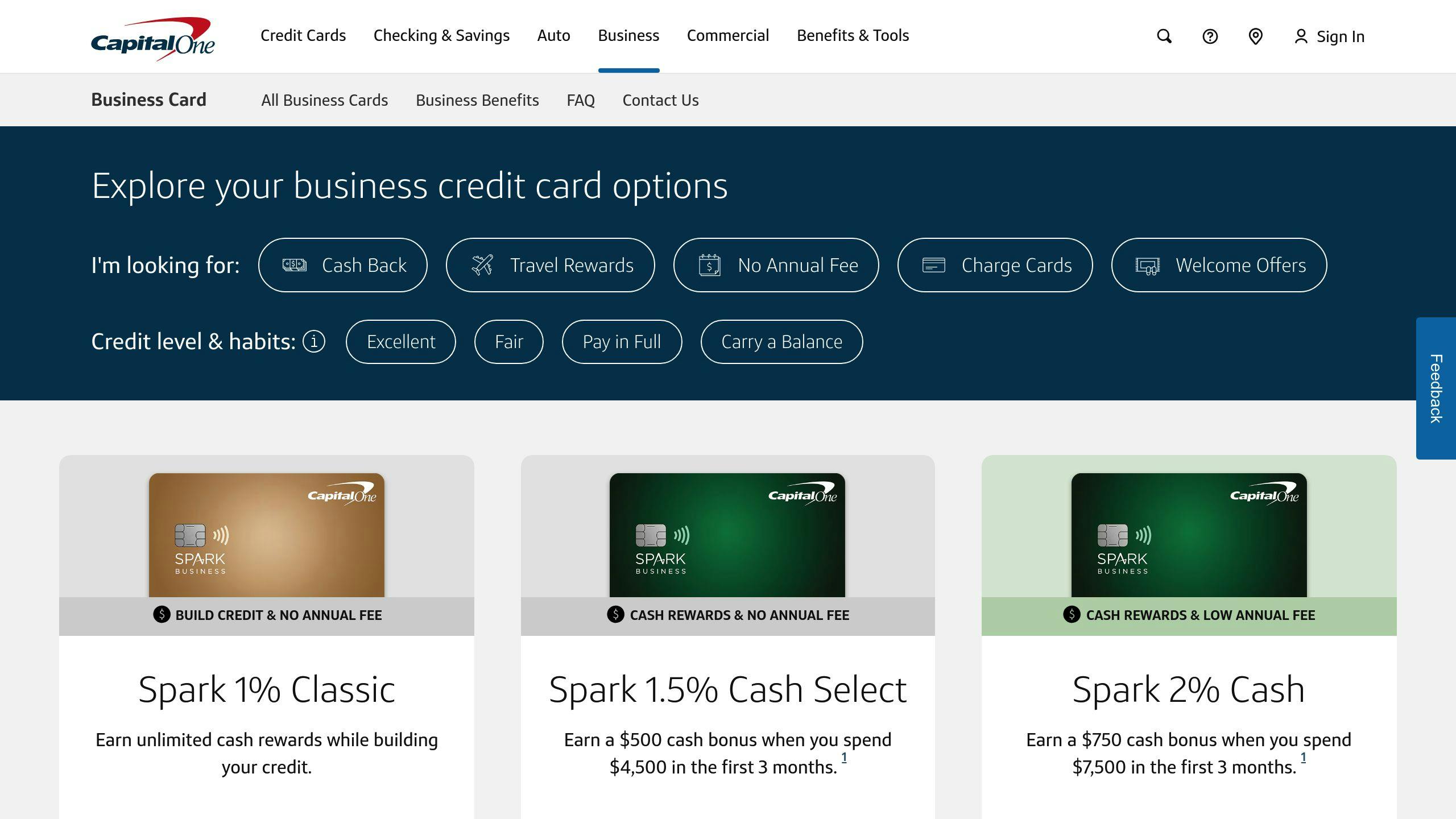

2. Capital One Spark Cash Plus

The Capital One Spark Cash Plus is a straightforward choice for businesses seeking consistent rewards without the hassle of tracking spending categories. It offers 2% cash back on every purchase, making it easy to earn rewards while managing cash flow effectively. Plus, as a charge card, it helps businesses avoid carrying a balance and accumulating debt.

New cardholders can take advantage of a $500 cash bonus after spending $4,500 within the first three months. The card has no annual fee for the first year, then charges $95 annually moving forward.

This card is also equipped with tools to simplify expense management. It integrates seamlessly with popular accounting software, making it easier to track expenses and prepare for tax season. The unlimited 2% cash back is especially useful for businesses with diverse spending patterns, offering consistent rewards regardless of where the money is spent.

Here’s a breakdown of the rewards potential based on different spending levels:

| Monthly Spending | Annual Cash Back | Net Value* |

|---|---|---|

| $5,000 | $1,200 | $1,105 |

| $10,000 | $2,400 | $2,305 |

| $15,000 | $3,600 | $3,505 |

*Net value accounts for the $95 annual fee after the first year.

Additional benefits include purchase protection, extended warranties, and no foreign transaction fees. The Capital One app and online portal offer comprehensive account management features, such as real-time tracking, custom alerts, and detailed reporting, making it easier to stay on top of business expenses.

For businesses that value simplicity and consistent rewards, the Spark Cash Plus delivers reliable cash-back benefits and robust expense management tools. Its flat 2% return on all purchases eliminates the need to worry about rotating categories or spending caps.

While this card shines for its straightforward rewards, the next option focuses on bonuses tailored to specific spending categories.

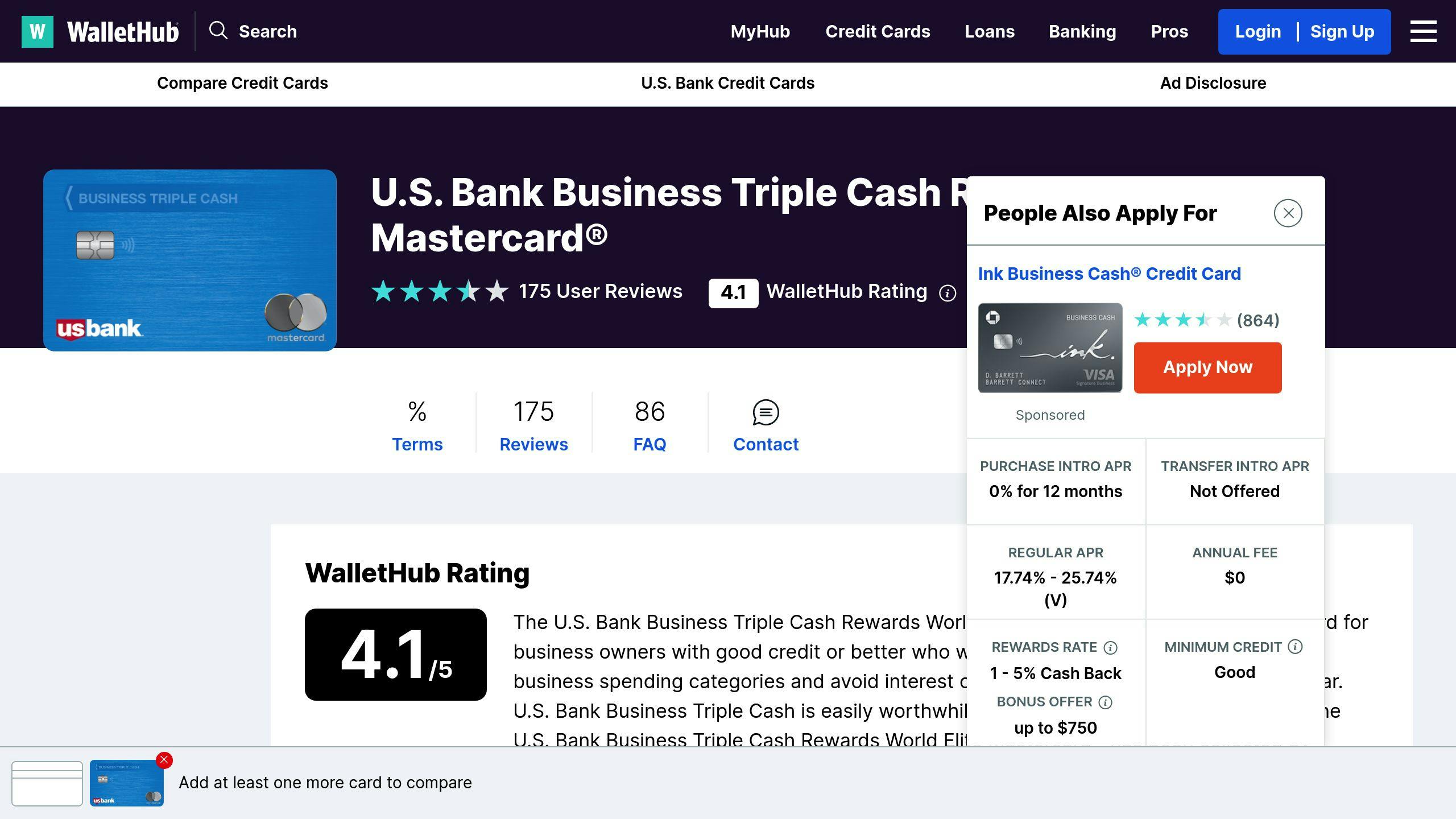

3. U.S. Bank Business Triple Cash Rewards World Elite Mastercard

The U.S. Bank Business Triple Cash Rewards World Elite Mastercard stands out by offering bonus cash back in specific spending categories. You'll earn 3% cash back on purchases at gas stations, EV charging stations, office supply stores, and cell phone service providers. On top of that, it provides 2% cash back at restaurants and 1% back on everything else, making it a solid choice for businesses with varied expenses.

One of its standout features is the 0% APR for 15 billing cycles on both purchases and balance transfers. After that, the APR ranges from 18.99% to 27.99% (variable). Plus, there's no annual fee for the first year - though a $95 fee kicks in after that. For businesses spending heavily in the 3% categories, this card can deliver up to $1,800 in cash back annually, thanks to the $150,000 cap on bonus category spending.

This card is a great match for businesses with regular expenses in office supplies, fuel, or telecom services. It also simplifies expense tracking with spending reports and accounting software integration, making it easier to manage high operating costs.

Additional perks include travel insurance, purchase protection, extended warranties, 24/7 concierge service, and identity theft protection, all part of the World Elite Mastercard benefits package.

If your business needs a card with unlimited rewards across all spending categories, you might want to check out the next option.

sbb-itb-ee18a7b

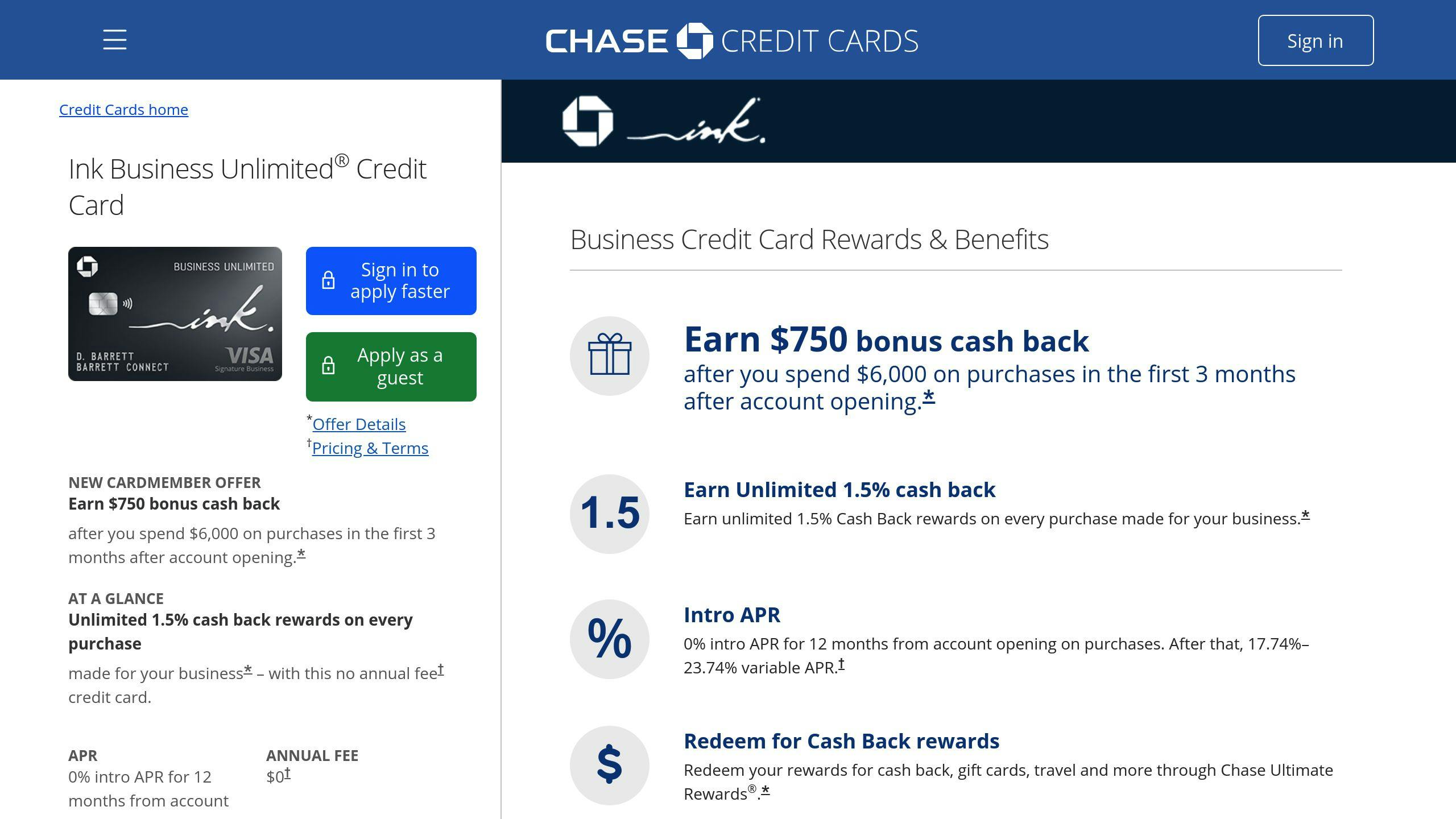

4. Ink Business Unlimited Credit Card

The Ink Business Unlimited Credit Card from Chase gives you 1.5% cash back on every purchase - no categories, no limits. This straightforward rate is great for businesses with mixed spending habits, where tracking specific categories might be a hassle.

New cardholders can snag $900 cash back after spending $6,000 in the first 3 months. Plus, there's no annual fee and a 0% intro APR for 12 months on purchases. After that, the APR ranges from 18.99% to 24.99%, depending on your credit.

Chase also offers handy tools for managing expenses, like spending limits, automatic categorization, and detailed reports. These features make it easier for small business owners to focus on their work instead of juggling complicated rewards systems.

One downside? A 3% foreign transaction fee, which means this card isn’t the best for international purchases. Still, many businesses report earning more consistent cash back with this card compared to those with category-specific rewards [1].

With its flat cash back rate and no annual fee, this card is a simple and budget-friendly option for businesses with varied expenses. But if you need perks like no foreign transaction fees, another card might suit you better.

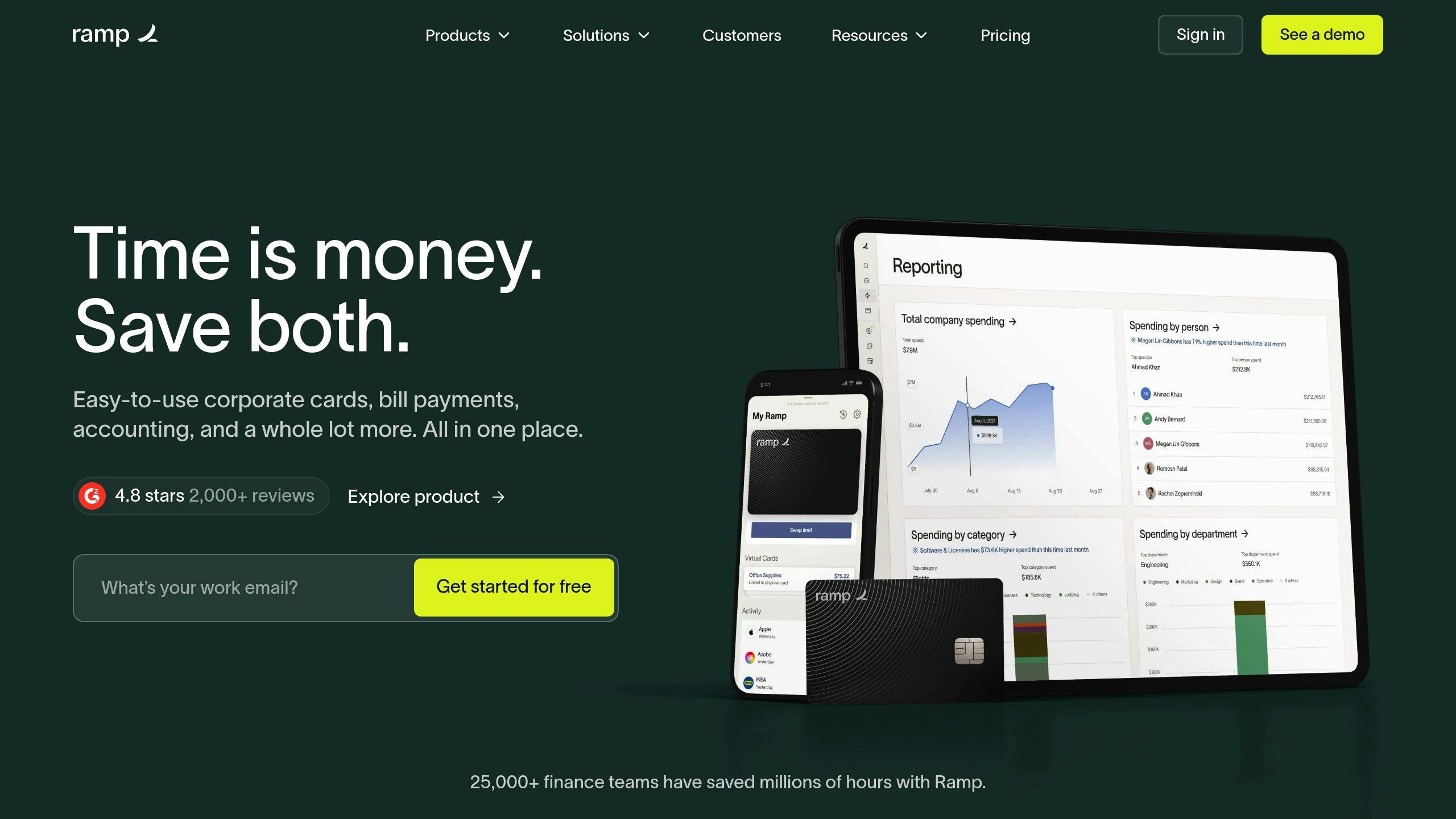

5. Ramp Business Credit Card

The Ramp Business Credit Card stands out with its unlimited 1.5% cash back and zero fees, making it a smart choice for small businesses aiming to keep expenses low. For businesses managing a variety of costs, Ramp offers an easy way to handle payments without worrying about fees or interest - provided the balance is paid in full.

What makes Ramp unique is its focus on expense management. The card works seamlessly with accounting tools like QuickBooks and Xero, while also allowing businesses to set spending limits and receive real-time transaction alerts.

"Ramp saves businesses time and money by automating expense tracking and offering 1.5% cash back on all purchases." - Eric Glyman, Co-Founder and CEO of Ramp

Ramp's automated system simplifies bookkeeping by tracking expenses and generating clear reports, saving businesses hours of manual work. Features like spending controls are especially helpful for companies with multiple employees or complex spending patterns.

Unlike many traditional business credit cards, Ramp goes beyond basic rewards. It highlights ways to cut costs, such as eliminating duplicate subscriptions, adding an extra layer of value. That said, the card does have strict credit requirements, which may limit access for some businesses. But for those that qualify, the combination of automation, rewards, and cost-saving tools makes it a strong financial resource.

Ramp’s zero fees and expense management tools make it a compelling option, but how does it stack up against other business credit cards?

Comparison Table

Here's a side-by-side look at the key features of these business credit cards:

| Feature | Hello Alice Business Mastercard | Capital One Spark Cash Plus | U.S. Bank Triple Cash | Ink Business Unlimited | Ramp Business Card |

|---|---|---|---|---|---|

| Annual Fee | $0 | $150 | $0 | $0 | $0 |

| Sign-Up Bonus | $50 statement credit after spending $1,000 in the first 3 billing cycles | Up to $1,000 cash bonus | $500 cash back | $900 bonus cash back | N/A |

| Rewards Rate | • 4x points on wireless and business software • 3x points on office supplies and shipping • 2x points on rideshares and restaurants • 1.5x points on other purchases |

2% cash back on all purchases | • 3% cash back on eligible purchases • 1% cash back on other purchases |

1.5% cash back on all purchases | 1.5% cash back on all purchases |

| Intro APR | 0% for the first 6 billing cycles | N/A | 0% for 15 billing cycles | 0% for 12 months | N/A |

| Regular APR | 19.99%-28.99% Variable | N/A (Pay in full monthly) | 18.74%-27.74% Variable | 18.49%-24.49% Variable | N/A (Pay in full monthly) |

| Notable Perks | • Standard Mastercard perks • Car rental insurance • ID theft protection |

• No preset spending limit • Employee cards at no cost |

• Zero fraud liability • Account management tools |

• Purchase protection • Extended warranty |

• Automated expense tracking • Spending controls |

This table is designed to help small business owners find the best card for their needs. For example, Hello Alice stands out with rewards tailored to specific categories, while Ramp focuses on tools for expense management and cost control.

If your business spends heavily on office supplies, the U.S. Bank Triple Cash Rewards card may be a strong choice. On the other hand, the Capital One Spark Cash Plus offers straightforward value with flat-rate rewards.

Ultimately, the best card depends on your business's spending habits and financial priorities.

Conclusion

Choosing the right business credit card can help small businesses manage finances more effectively and open doors to growth opportunities. These cards are designed to meet different spending patterns and needs, offering features that can support business objectives.

As mentioned earlier, small businesses often struggle to access financial tools, making it essential to pick a credit card that fits their specific needs. When reviewing your options, keep these factors in mind:

- Match rewards and APR features to your spending habits and cash flow.

- Consider annual fees versus benefits such as credit-building opportunities and expense tracking tools.

Each card discussed has its own strengths. For instance, the Hello Alice Small Business Mastercard focuses on serving underrepresented communities, with 68% of its business owners identifying as BIPOC and 63% as female [1]. On the other hand, the Capital One Spark Cash Plus offers simple cash-back rewards, perfect for businesses that value straightforward benefits.

To find the best fit:

- Assess your business's spending patterns, feature requirements, and credit-building goals.

- Refer to the comparison table to narrow down your options.

The right business credit card does more than just process payments - it can be a tool to help you achieve both short-term needs and long-term objectives. Use the comparison table to identify the card that aligns best with your business's priorities. </

FAQs

What is the best business credit card for startups?

Choosing the right business credit card can make a big difference for startups, depending on your priorities. Here are a few standout options:

- If you want no annual fee: The Blue Business® Plus Credit Card from American Express is a solid choice, offering credit-building tools without any yearly fees.

- For cash back rewards: The Ink Business Unlimited® Credit Card gives you unlimited 1.5% cash back on all purchases, making it great for startups with varied expenses.

- For frequent travelers: The Business Platinum Card® from American Express offers excellent travel benefits. While it has a higher annual fee, it’s ideal for startups with larger travel budgets.

Things to keep in mind for startups:

- Look for no-annual-fee options to keep costs low.

- Take advantage of 0% intro APR offers to manage early-stage spending.

- Pick rewards programs that match your spending habits.

- Use business tools provided by the card to track and manage expenses.

For instance, the Hello Alice Small Business Mastercard offers 0% intro APR for six billing cycles and features designed to help build credit [2]. This makes it a great option for startups working on establishing their financial foundation.