Managing your business finances doesn’t have to be complicated. The right accounting software can save time, reduce errors, and improve decision-making. This guide compares five popular tools tailored for small businesses: QuickBooks Online, FreshBooks, Xero, Wave, and Zoho Books. Here’s a quick rundown:

- QuickBooks Online: Best for scalability and advanced features but higher cost.

- FreshBooks: Ideal for service-based businesses with strong invoicing and time tracking.

- Xero: Unlimited users and great for inventory-heavy businesses.

- Wave: Free option for freelancers and startups with basic needs.

- Zoho Books: Affordable with a free plan, suited for startups and mobile teams.

Quick Comparison

| Software | Starting Price | Key Features | Best For |

|---|---|---|---|

| QuickBooks Online | $30/month | Advanced tools, payroll integration | Growing businesses, accountants |

| FreshBooks | $18/month | Time tracking, client management | Service-based businesses |

| Xero | $15/month | Unlimited users, inventory tools | Retail, inventory-heavy businesses |

| Wave | Free | Invoicing, expense tracking | Freelancers, startups |

| Zoho Books | Free/$20/month | Mobile-friendly, project management | Startups, mobile teams |

Choose based on your budget, features, and business needs. Dive into the full article for detailed insights and comparisons.

Best Accounting Software: Xero vs QuickBooks vs FreshBooks vs Wave vs Sage

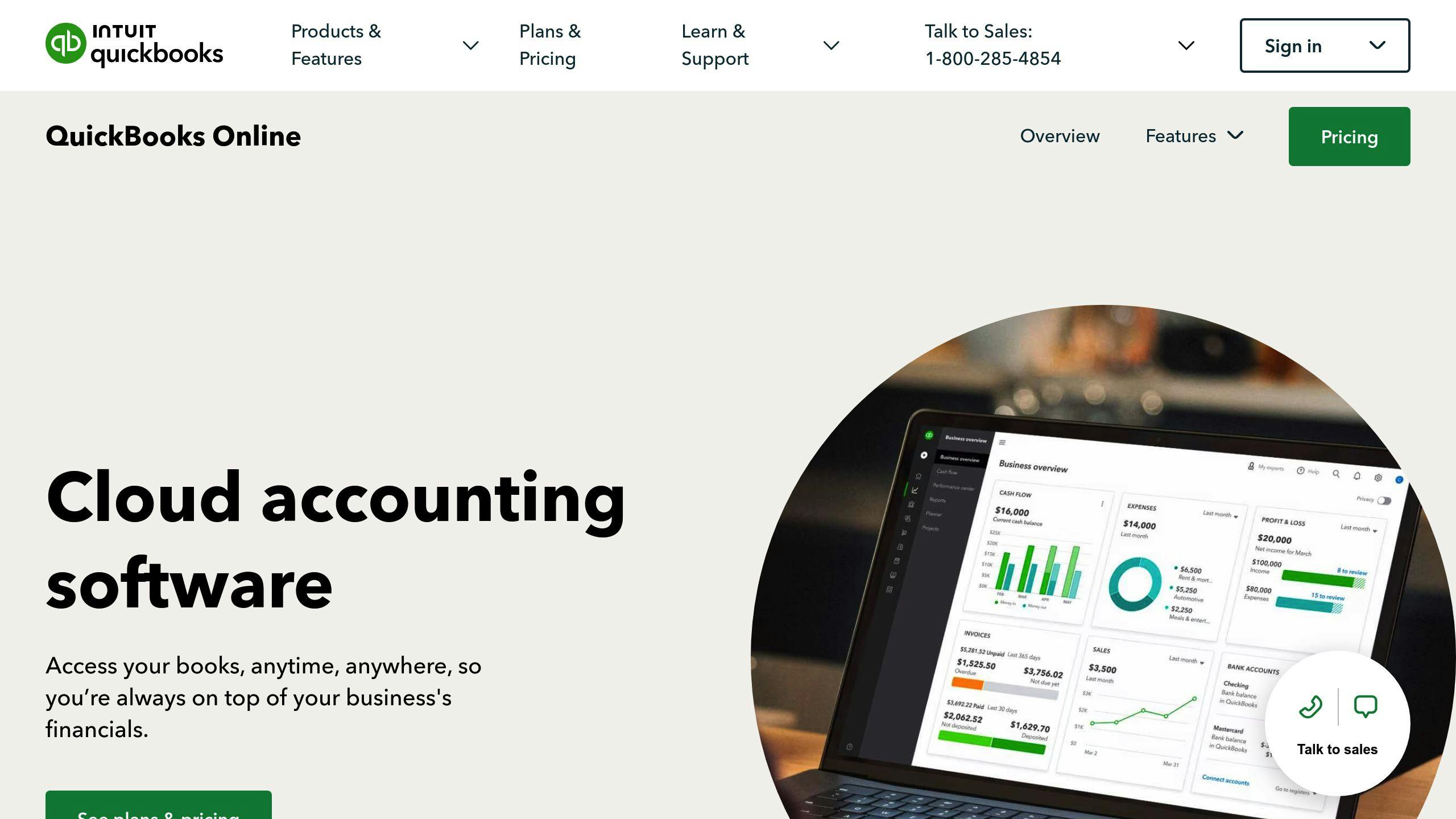

1. QuickBooks Online Overview

QuickBooks Online is a cloud-based accounting software designed for small businesses. It offers four pricing plans to cater to different needs:

| Plan | Monthly Cost | Key Features |

|---|---|---|

| Simple Start | $30 | Tracks income/expenses, invoicing, basic reports |

| Essentials | $60 | Bill management, time tracking, multiple users |

| Plus | $99 | Inventory tracking, project profitability |

| Advanced | $200 | Custom user permissions, dedicated support |

Getting started is straightforward thanks to its setup wizard, which is known to be more user-friendly than competitors like Zoho Books [1]. The platform automates many tasks, and its mobile app handles payment processing, receipt uploads, and mileage tracking.

QuickBooks Online also integrates seamlessly with payroll and bookkeeping services, giving businesses flexible options for managing their finances [2]. Its accounts payable tools, such as vendor management and recurring payments, earned a perfect score from Fit Small Business [4].

Key Strengths

- Wide range of features

- Excellent mobile app functionality

- Integration with payroll and bookkeeping

- Automated billing and invoicing

Considerations

- Limited users on lower-tier plans

- Costs more than alternatives like Zoho Books

- Some features might be unnecessary for smaller businesses

For businesses looking to scale or work closely with accountants, QuickBooks Online offers robust tools and flexibility [2]. Up next, we’ll see how FreshBooks stacks up for small business accounting.

2. FreshBooks Overview

FreshBooks is a cloud-based accounting software designed specifically for small service-based businesses. Its user-friendly design and focused features make it a practical option for smaller operations, standing out as an alternative to QuickBooks Online.

The platform offers several pricing plans to suit various business requirements:

| Plan | Monthly Cost | Annual Cost | Client Limit | Key Features |

|---|---|---|---|---|

| Lite | $18 | $15 | 5 | Basic invoicing, expense tracking |

| Plus | $30 | $25 | 50 | Recurring billing, client retainers |

| Premium | $60 | $50 | Unlimited | Project profitability tracking |

| Select | Custom | Custom | Unlimited | Dedicated account manager |

FreshBooks is particularly strong in time-tracking and project management. It also simplifies expense tracking by letting users link their bank accounts and credit cards, making reconciliation much easier.

Key Features

FreshBooks enables users to create professional invoices using customizable templates. Payments can be accepted through multiple gateways, and the client portal provides a centralized space for customers to view invoices, make payments, and access project-related documents.

Integrations

The software connects seamlessly with popular tools like Stripe, PayPal, Shopify, Asana, and Trello. Its mobile apps for iOS and Android ensure you can manage your accounting tasks anytime, anywhere.

FreshBooks also offers a 30-day free trial, allowing businesses to explore its features before subscribing. It’s particularly suited for service-based companies that prioritize client management and time tracking over inventory management.

While FreshBooks is well-suited for service-oriented businesses, Xero might be a better fit for small businesses needing a wider range of features.

3. Xero Overview

Xero is a cloud-based accounting software designed for small and medium-sized businesses. It offers a range of tools to simplify financial management and streamline operations.

Pricing Structure

| Plan | Monthly Cost | Key Features |

|---|---|---|

| Early | $15 | Basic invoicing, 20 transactions |

| Growing | $32 | Unlimited invoicing, Bulk reconciliation |

| Established | $78 | Multi-currency, Project tracking, Analytics |

One standout aspect of Xero is its unlimited user access across all plans. This makes it a practical option for businesses with multiple team members needing access to the same financial system.

Core Features

Xero provides a robust set of tools tailored to small business needs, including:

- Automated Financial Management: Simplifies invoicing and integrates directly with banks to track transactions.

- Inventory Control: Helps monitor stock levels and manage purchase orders efficiently.

- Project Management Tools: Includes tracking features to keep workflows on track.

- Multi-Currency Support: Available in the Established plan, useful for businesses operating internationally.

Integration Capabilities

Xero connects with a variety of business tools through its App Store, enabling seamless integration with:

- Payment gateways

- E-commerce platforms

- CRM systems

- Inventory management tools

- Project management software

These integrations help automate workflows and simplify complex processes, making it easier to scale operations.

Business Suitability

Xero works well for retail businesses that need inventory management and teams that require multi-user access. While its advanced features may involve a learning curve, the platform offers tutorials and guides to ease the process.

Its real-time dashboards and reports enable better decision-making based on up-to-date data. However, businesses looking for a no-cost solution might consider alternatives like Wave.

sbb-itb-ee18a7b

4. Wave Overview

Wave is a cloud-based platform tailored for small businesses and freelancers. It offers a free core accounting system packed with tools to handle essential financial tasks.

Pricing Structure

| Service | Cost |

|---|---|

| Core Accounting | Free |

| Payment Processing | 2.9% + $0.30 per transaction |

| Payroll | Starting at $19/month |

Key Features

Wave makes managing finances straightforward with its user-friendly interface. Some highlights include:

- Customizable invoicing with automatic payment reminders to help maintain cash flow.

- An expense tracking system that allows receipt scanning and easy categorization.

- Bank connections for automatic reconciliation, saving time and reducing errors.

Business Intelligence Tools

Wave includes financial reporting tools that provide insights into your business's performance. Real-time dashboard analytics help users make informed decisions quickly.

Integration Capabilities

The platform integrates with popular payment gateways and e-commerce services, ensuring smooth operations. Additionally, Wave's mobile app offers access to key features while on the move.

Ideal Business Fit

Wave works best for:

- Freelancers and solo entrepreneurs

- Small service-based businesses

- Startups with basic accounting needs

- Businesses focused on minimizing costs

For those prioritizing affordability, Wave delivers essential accounting tools without a price tag. Its simple design is perfect for users with little to no accounting background. However, businesses needing more advanced features may find the free plan limiting. Keep in mind the additional costs for payment processing and payroll services when estimating total expenses.

While Wave is a fantastic choice for simplicity and cost-effectiveness, businesses looking for more advanced tools might explore options like Zoho Books.

5. Zoho Books Overview

Zoho Books is a cloud-based accounting platform that blends affordability with a solid range of features. It caters to businesses at various stages of growth, offering flexible plans and tools.

Pricing Structure

| Plan | Monthly Cost | Key Features |

|---|---|---|

| Free | $0 | Basic accounting, invoicing, expense tracking |

| Standard | $20 | Bank reconciliation, recurring transactions |

| Professional | $50 | Project tracking, inventory management |

| Premium | $70 | Custom domains, vendor portal |

| Elite | $150 | Advanced analytics, custom workflows |

| Ultimate | $275 | 30 users, advanced customization |

Core Features

Zoho Books provides essential accounting tools, with highlights including:

- Real-time inventory tracking with automatic updates

- Project accounting tools for tracking time and expenses

- Automated workflows for approvals in sales and purchases

- Multi-currency support for international transactions

- Client portal for better collaboration with customers

Mobile Accounting

Zoho Books stands out for its mobile-friendly approach. Its mobile apps allow business owners to handle finances anytime, anywhere.

Integration Ecosystem

One of Zoho Books' key strengths is its seamless integration with other Zoho apps. This creates a unified system that simplifies operations across different business functions.

Business Fit

Zoho Books is a good match for:

- Companies with mobile teams

- Businesses needing strong inventory tracking

- Organizations managing international transactions

- Startups aiming to expand their financial tools

While Zoho Books offers strong features at competitive prices, it does have some limitations. For instance, it lacks advanced reporting options like built-in trial balance and detailed 1099 reporting, which are available in tools like QuickBooks Online [1]. However, its mobile capabilities and integration with Zoho's ecosystem make it a great option for modern small businesses.

Next, let’s see how these accounting tools compare across important features to help you choose the right one.

Comparison of Pros and Cons

Here's a quick breakdown of the strengths and drawbacks of each accounting software to help you decide:

| Software | Pros | Cons |

|---|---|---|

| QuickBooks Online | • Wide range of features • Integrated electronic bill payments • Large network of ProAdvisors • Helpful onboarding tools |

• Higher cost • User limits on plans • Can feel complex for beginners |

| Xero | • Unlimited users on all plans • Built-in inventory tools • Fixed asset tracking included • Affordable pricing |

• Limited live support • Fewer third-party app options • Basic reporting features |

| Zoho Books | • Free plan available for small businesses • Strong mobile app • Project management tools • Budget-friendly plans |

• Limited advanced reporting options • Basic 1099 reporting • Setup process can be tricky |

Key Decision Factors

Here are some specific points to consider when choosing the right software:

Access Needs: If you need multiple users, Xero stands out with unlimited access on all plans, unlike others that cap users based on subscription levels [4][6].

Budget-Friendly Options: Zoho Books is a great pick for startups, offering a free plan and affordable pricing [3].

Feature Variety: QuickBooks Online offers the most extensive tools, but Xero and Zoho Books can meet specialized needs depending on your focus [4].

Mobile Usability: All platforms have mobile apps, but Zoho Books takes the lead with its robust tools for managing tasks on the go [1][2].

Industry-Specific Solutions

Each platform has strengths tailored to different business types:

- Xero: Ideal for businesses with heavy inventory needs, thanks to built-in stock tracking [4].

- Zoho Books: Best for service-based companies that require project and time management tools [3].

- QuickBooks Online: Designed for businesses looking to scale with advanced features [4].

Final Thoughts

Choosing the right accounting software is an important decision that can shape how efficiently your small business manages its finances. Here are a few key points to consider when making your choice:

Balancing Cost and Features: Accounting software comes in a range of price points. For example, QuickBooks Online costs between $30 and $200 per month and offers a wide array of tools, along with strong local support through its ProAdvisor network [1][2]. On the other hand, Zoho Books provides a free tier for startups earning less than $50,000 annually, making it an excellent option for smaller budgets [3][5].

Planning for Growth: If you're expecting your business to expand, you'll need software that can grow with you. Xero, for instance, supports unlimited users across all its plans, priced from $15 to $78 per month. This makes it a great choice for businesses with growth in mind [4][6].

Industry-Specific Needs: Different industries have different requirements. Zoho Books works well for service-based businesses, Xero is ideal for companies with heavy inventory needs, and QuickBooks Online is a solid choice if you value local support [1][2].

Support and Ease of Setup: Reliable customer support is essential, especially if you're not tech-savvy. QuickBooks Online stands out for its onboarding process and local support network, while other platforms may have more limited assistance available [1][2].

The most expensive software isn’t always the best fit. The key is to align your business needs, budget, and growth plans with the features and support each platform offers.

For more insights, check out the FAQs below to address common questions about choosing accounting software.

FAQs

These FAQs expand on the comparisons above, offering quick answers to help small business owners choose the right accounting software for their needs.

What is the easiest free accounting software to use?

Wave Accounting stands out as a user-friendly option for small businesses, providing an easy-to-navigate interface and essential features for free. Zoho Books also offers a no-cost plan for businesses earning under $50,000 annually, making it a solid choice for startups [3][5].

Which accounting program has no monthly fee?

Both Wave and Zoho Books provide free plans with essential features. Brightbook caters to freelancers, and ProfitBooks offers inventory tracking tools without a subscription fee [4]. These options are great for businesses looking to save on costs.

What is the simplest accounting software for small businesses?

Xero is often praised for its straightforward interface and ability to support unlimited users. Zoho Books is another easy-to-use option, with mobile-friendly tools for tracking time and managing expenses [1][4][6].

Which software is best for an accounting business?

QuickBooks Online is a top pick for accounting businesses, offering tools to efficiently manage multiple clients [4][6]. Key features include access to ProAdvisors, live bookkeeping services, and advanced reporting. Its scalability and extensive support network make it a reliable choice for professionals handling various client accounts [1][2].